BTC Price Prediction: $130K in Sight as Institutional Demand Meets Technical Strength

#BTC

- Technical Strength: Price above key MAs with MACD bullish crossover

- Institutional Tailwinds: ETFs and corporate adoption provide stability

- Macro Alignment: Geopolitical events boosting crypto as hedge

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

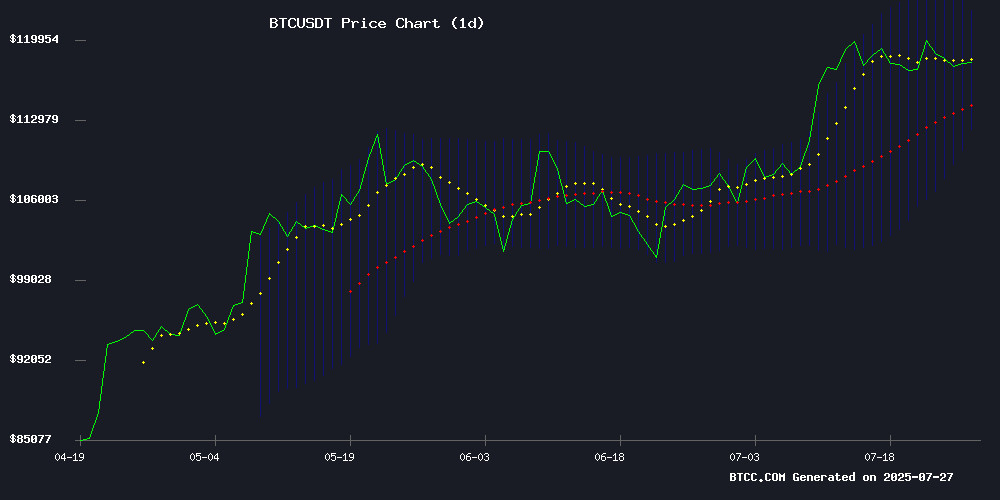

BTC is currently trading at 119,098.65 USDT, above its 20-day moving average of 117,385.16, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 1,795.3156, suggesting upward momentum. Bollinger Bands reveal price hovering NEAR the upper band (122,645.74), signaling potential overbought conditions but also strength. According to BTCC financial analyst Olivia, 'The technical setup supports a continuation of the uptrend, with key resistance at 122,650 USDT.'

Market Sentiment: Institutional Adoption Fuels BTC Optimism

Recent headlines highlight institutional confidence, with MicroStrategy's new Bitcoin-backed financial instrument and Trump's trade deal sparking a rally past $119K. BTCC's Olivia notes, 'ETF-driven stability is replacing volatility, creating a firmer floor near $110K.' Whale activity remains a wildcard, but overall sentiment leans bullish as institutional inflows grow.

Factors Influencing BTC’s Price

MicroStrategy Signals Next Phase of Bitcoin Accumulation Strategy

MicroStrategy's relentless Bitcoin acquisition strategy shows no signs of slowing. The enterprise software firm now holds 607,770 BTC worth approximately $71.8 billion, cementing its position as the largest corporate holder of the cryptocurrency.

CEO Michael Saylor's recent social media activity suggests another imminent purchase. Historical patterns indicate his portfolio tracker posts typically precede official buy announcements. The company recently resumed weekly purchases after a brief pause, adding over 4,000 BTC last week alone.

With $4.2 billion in unspent capital from previous offerings and fresh proceeds from a $2.4 billion stock sale, MicroStrategy appears poised to continue its aggressive accumulation. The firm's consistent buying pattern demonstrates unwavering conviction in Bitcoin as a treasury reserve asset.

Bitcoin Enters New Phase as ETFs Replace Price Spikes with Stability

Bitcoin is transitioning into a more stable asset class, driven by growing institutional adoption and the influence of spot Bitcoin ETFs. Bloomberg analyst Eric Balchunas notes that dramatic price surges, colloquially known as "God candles," are becoming increasingly rare in this new era.

The approval of spot Bitcoin ETFs has introduced a steadier inflow of capital, reducing the frequency of extreme price corrections. Institutional investors are now the dominant force, supporting gradual price growth and long-term market stability. Citigroup analysts project Bitcoin could reach $199,000 by year-end, fueled by sustained ETF inflows.

This shift marks a maturation of the cryptocurrency market, with volatility tempered and predictability enhanced. The involvement of major financial players like BlackRock has not only bolstered Bitcoin's price—up roughly 250% since their ETF filing—but also its credibility as a potential mainstream currency.

Bitcoin Eyes $130K as Key Support Holds Above $110K

Bitcoin's bullish momentum continues as it trades above $118,000, with analysts projecting a potential surge to $130,000 if critical support levels hold. The $110,000–$112,000 range is now viewed as a make-or-break zone for sustaining upward trajectory.

Technical models from Glassnode pinpoint $110,756 as the linchpin—a level that could propel BTC toward its +2.0 sigma target. Market structure remains decidedly bullish, yet capital inflows haven't mirrored previous cycle peaks, suggesting this rally still has room to mature before reaching euphoric extremes.

Trump Announces US-EU Trade Deal, Bitcoin Surges Past $119,000

The United States and European Union have finalized a landmark trade agreement after months of negotiations. President Trump and EU Commission President Von der Leyen announced the deal hours before the August 1 deadline, with immediate market repercussions.

Bitcoin rallied to $119,068 following the news, reflecting heightened investor optimism. The agreement includes $600 billion in EU investments to the US, duty-free trade provisions, and substantial military equipment purchases. A 15% tariff on automotive trade was established as part of the comprehensive package.

Energy exports feature prominently in the accord, with the EU committing to significant purchases of US liquefied natural gas. "This deal will unite us," Trump declared during the announcement, emphasizing the strategic importance of transatlantic economic cooperation.

Bitcoin Whale's $9 Billion Sale Sparks Debate on Crypto's Founding Principles

A seismic transaction shook the cryptocurrency market as Galaxy Digital facilitated the sale of 80,000 Bitcoin tied to a Satoshi-era investor, netting approximately $9 billion. The move, framed as part of estate planning, reignited debates about Bitcoin's ideological purity versus its evolution into a tradable asset class.

Critics argue such large-scale disposals undermine Bitcoin's anti-establishment roots, while pragmatists view it as inevitable portfolio management. Notable trader Scott Melker observed a growing divergence between early adopters' ideals and current market realities, stating Bitcoin has been "seized by those it initially sought to bypass."

The transaction highlights Bitcoin's dual identity: a revolutionary protocol battling its own success as institutional money floods the space. Market observers note this isn't a death knell, but rather a maturation phase where philosophical purity collides with financial practicality.

Michael Saylor's MicroStrategy Unveils Bitcoin-Backed Financial Instrument

MicroStrategy (MSTR) is pioneering a novel financial instrument that leverages Bitcoin's long-term appreciation to deliver stable yields. The $2 billion STRATEGY Preferred Stock (STRC) offering functions as a hybrid between a money-market fund and a crypto-backed security, offering a variable 9% dividend while maintaining price stability around $100 per share.

Though investors don't gain direct Bitcoin exposure, the structure is fundamentally supported by MicroStrategy's massive $71.7 billion BTC holdings. The company's conservative balance sheet—with just $11 billion in liabilities—provides a buffer against crypto market volatility, enabling consistent payouts even during downturns.

Historical Bitcoin returns of 3-4% annually over any five-year period form the bedrock of this financial engineering. MicroStrategy essentially monetizes BTC's appreciation without liquidating holdings, transforming volatility into predictable cash flow. "STRC represents a paradigm shift—high-yield returns traditionally associated with risk assets, delivered with money-market-like stability," analysts note.

Bitcoin Surges 10% as Institutional Adoption Drives Market Optimism

Bitcoin's price soared 10% today, reaffirming its status as digital gold amid growing institutional adoption and regulatory progress. Bitwise CIO predicts a sustained bullish trajectory for the asset, citing macroeconomic tailwinds.

FindMining capitalizes on the momentum with new cloud mining contracts, offering investors a passive income channel. The platform eliminates hardware barriers, allowing BTC holders to earn daily yields through computational power leasing.

Robert Kiyosaki Advocates Direct Bitcoin Ownership, Cautions Against ETF Risks

Robert Kiyosaki, the renowned personal finance author, has issued a stark warning to Bitcoin investors about the pitfalls of relying on exchange-traded funds (ETFs). In a recent social media post, he underscored the critical distinction between holding Bitcoin directly and gaining exposure through ETFs, which he likened to owning a "paper" representation of the asset rather than the asset itself.

While Kiyosaki acknowledged the convenience of ETFs for mainstream investors, he emphasized their inherent limitations. "Owning an ETF is like carrying a photograph of a weapon instead of the real thing," he remarked, advocating for physical possession of assets like gold, silver, or Bitcoin. His comments come amid growing institutional interest in Bitcoin ETFs, with custodians such as Coinbase playing a pivotal role in backing these products with 1:1 reserves.

The debate over direct ownership versus ETF exposure highlights broader tensions in the cryptocurrency market. As institutional adoption grows, Kiyosaki's stance serves as a reminder of the fundamental principles of asset control and self-custody in an increasingly financialized digital economy.

Bitcoin Maintains Strong Consolidation Amid Institutional Inflows, BJMINING Offers Cloud Mining Solution

Bitcoin exhibited robust price action on July 27, 2025, oscillating between $117,760 and $120,000 before settling into a strong consolidation pattern. Institutional capital continues flowing into the market, with ETF products recording net inflows despite minor daily fluctuations. Analysts anticipate a potential breakout toward $150,000 by year-end if accumulation concludes.

BJMINING positions itself as a low-barrier entry point for retail investors seeking exposure to Bitcoin's volatility. The cloud mining platform emphasizes zero technical requirements and stable yields, capitalizing on bullish market sentiment. Large wallet addresses maintain net accumulation, suggesting confidence in the ongoing bull cycle.

BTC Tests Key Support as SunnyMining Launches Automated Cloud Mining Solution

Bitcoin continues to consolidate near critical support levels, maintaining its position as digital gold despite short-term volatility. The asset's role in global portfolio strategies remains unchallenged, with investors increasingly seeking passive income avenues beyond active trading.

SunnyMining enters this landscape with an automated cloud mining solution that eliminates hardware requirements and technical barriers. The platform promises daily Bitcoin payouts through flexible contract options, ranging from short-term trials to high-yield compounding strategies. Security is emphasized through cold and hot wallet implementations, addressing a key concern in crypto asset management.

$9 Billion Exit by Satoshi-Era BTC Whale Sparks Debate: Are Bitcoin OGs Losing Faith?

A seismic shift in Bitcoin's early-adopter dynamics emerged as Galaxy Digital facilitated an $9 billion sale of over 80,000 BTC for a Satoshi-era investor. The transaction, framed as part of estate planning, ignited fierce debate about whether Bitcoin's foundational believers are losing conviction.

Crypto analyst Scott Melker stoked controversy by suggesting Bitcoin's original anti-establishment ethos has been compromised, noting "many of the most ardent early whales have seen their faith shaken." The commentary divided the crypto community, with some dismissing the move as routine wealth management and others interpreting it as a worrying symbolic exit.

The debate reveals deepening fissures in Bitcoin's identity as it matures. While the mechanics of large wallet movements often defy simple interpretation, the psychological impact of such transactions on market sentiment remains undeniable. This episode underscores the tension between Bitcoin's ideological roots and its evolving role in global finance.

How High Will BTC Price Go?

BTC could challenge $130K if it holds above $117K (20-day MA). Key factors:

| Factor | Impact |

|---|---|

| Technical Breakout | 122,650 resistance → 130K target |

| Institutional Demand | ETFs/MicroStrategy reduce sell pressure |

| Macro Events | US-EU trade deal supports risk assets |

Olivia cautions: 'Watch MACD for sustained momentum—whale sales remain a risk.'

shown above